"Colourtext always take a fresh approach to discovering hidden patterns in data. Whether you want to conduct segmentation or mine your CRM for deep insights, they will help you see your customers , and what they are seeing , in new ways."

A new audio advertising measurement system designed for small and mid-sized media markets.

CampaignFX is a new audio advertising measurement system developed by Colourtext in partnership with Radiocentre Ireland that has been designed specifically for the needs of small and mid-sized media markets. It builds upon nearly 20 years of operational and development experience from Radiogauge, the widely acknowledged global standard for audio effectiveness, owned by Radiocentre in the UK.

The role of CampaignFX is to demonstrate the effectiveness of audio advertising to large national brand advertisers and provide evidence of audio’s long-term impact on brand growth. Its core mission is to address the competitive imbalance between audio advertising and digital ad platforms by providing brands with more comprehensive data on the effectiveness of their audio campaign investments.

Advertisers in many smaller national and sub-regional media markets receive little or no data on radio campaign effectiveness, which puts commercial audio channels at a disadvantage relative to digital ad platforms. This is because digital platforms typically have access to vast amounts of ad response data that provides advertisers with detailed insights into the performance of their campaigns.

With CampaignFX, commercial radio operators can now offer clients a qualitatively better data-driven approach to advertising evaluation at a cost that is sustainable over the long term. This allows radio advertisers to access more comprehensive data on the effectiveness of their campaigns across a broader range of brands and product categories.

CampaignFX achieves this by using a new category-based research methodology developed and trialled within the Irish market for Radiocentre Ireland. This innovative approach measures the performance of audio advertising within the natural context of all the other marketing activities undertaken by a brand and those of its main competitors.

You can watch Radiocentre Ireland's CampaignFX launch webinar video here.

Much like Radiogauge in the UK, CampaignFX measures key performance metrics such as advertising awareness, brand consideration and purchase intent. In addition, it incorporates Category Entry Point (CEP) analysis, as developed by the Ehrenberg Bass Institute, to measure brand advertising effects. This gives brands a deeper level of insight into the long term impact of audio advertising on consumer brand perception and purchase behaviour.

As part of this mission to improve the general understanding of audio's effectiveness as an advertising channel, we've undertaken a substantial meta-analysis of all the data collected by CampaignFX in Ireland to date. We've completed 5 individual waves of research, with each survey contacting an average of 750 Irish consumers aged between 18 and 64. The meta-analysis aggregates these studies into a database over 3,750 individual interviews, providing detailed information about 31 major brand advertisers in Ireland.

So far as we're aware, this is the largest meta-analysis of audio advertising effectiveness data ever undertaken in Ireland, and we're excited to be able to share the findings of this study with you.

CampaignFX data collection & research methodology

To begin we'll look at the breadth and depth of data collected by CampaignFX to date. Our survey program began in September 2023 with a detailed look at 7 brands in the Personal Banking sector. This was followed by TV and Video Streaming brands in October and the Fast Food & Delivery category in November. Taking a break over the atypical Christmas period, we resumed again in January 2024 with a survey of 7 General Insurance brands followed in February by Health Insurance.

It's important to note that at the moment in time when each category survey went into field we had no awareness of what brands would, or would not, be advertising on the radio. This meant we could capture the most natural snapshot possible of advertising activity by leading brands within each category and across all media channels. We think this gives CampaignFX data and our meta-analysis database an extra measure of authenticity and real-world credibility.

Next we’re going to take a look at how we’ve organised this data and gone about the process of analysing it. CampaignFX is based upon the respected 'Test versus Control Group' research methodology used by studies like Radiogauge in the UK. However, this approach has been carefully modified for Ireland by using a ‘stratified two-factor test-versus-control' sample and analysis scheme, that can be explained as follows.

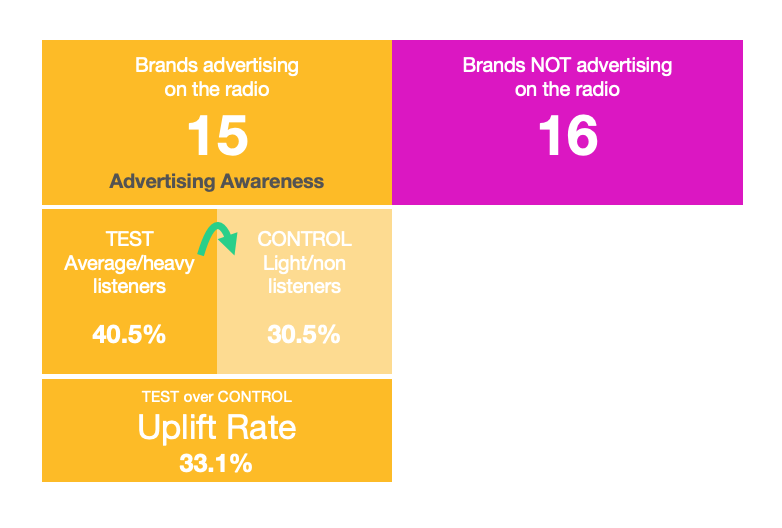

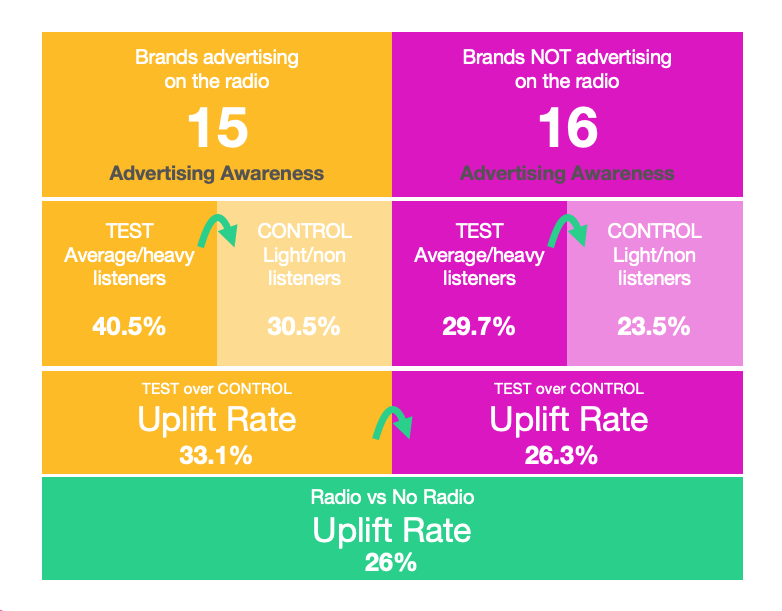

Each survey questionnaire includes the top 7 brands in each respective market category (note - only 4 brands for Health Insurance). We identify brands that were on-air with a radio campaign during the periods we ran a survey, which allows us to split the 31 brands we have data for into two groups:

A) brands that were advertising on the radio (N=15)

B) brands that were not on-air at the time of survey (N=16)

To make things simple we'll focus on the brands that were advertising on radio when our surveys were conducted. All of the people who took part in our surveys were also split into two groups:

1) The TEST group (~60%) is made up of people with the heaviest exposure to radio advertising - these are defined as average and heavy radio listeners.

2) Conversely, the CONTROL group (~40%) is made up of people with little or no exposure to radio advertising - these are defined as Light and Non-listeners to radio.

We'll now introduce some real survey data to make the next steps of the methodology easier to explain. One of the questions we ask measures the level of Advertising Awareness for each brand. In this case, amongst people with higher levels of exposure to radio advertising (the TEST group), the average level of Ad Awareness for brands using radio was 40.5%. That compares to a figure of just 30.5% amongst people with the lowest levels of exposure of radio advertising (our CONTROL group).

What does this mean? The level of ad awareness for the CONTROL group is what we can expect to see amongst people who have been exposed to everything a brand has done across all media channels but, crucially, have not been exposed to any brand activity delivered via the radio.

If we see an uplift in the TEST group’s level of ad awareness compared to the CONTROL group, we can therefore reasonably attribute the increase to the TEST group’s audio advertising exposure. In this case, the TEST group score is 10 percentage points higher than the score posted by the CONTROL group, which happens to be a 33.1% increase over the CONTROL group score. This is what we call the Uplift Rate.

Given we know how to calculate the Uplift Rate in Ad Awareness for brands that have been advertising on the radio, we can perform the same calculations for brands that have NOT been advertising on the radio. In this case, the Uplift Rate for brands not using radio is just 26.3%.

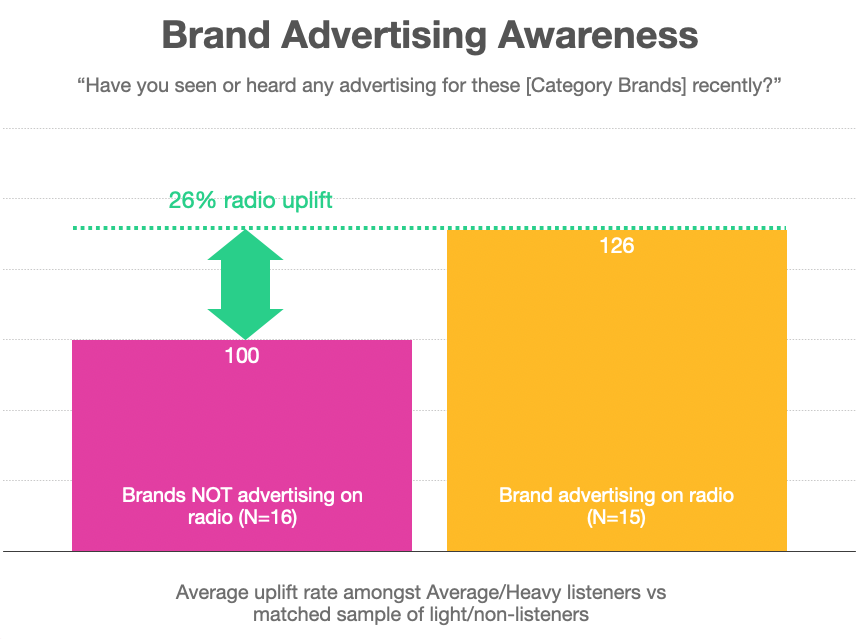

When we compare that to the prior uplift rate figure of 33.1%, we can see that on average Advertising Awareness for brands that have been active on the radio is actually 26% higher than for brands not using radio, which is a great finding. The pattern of analysis illustrated here is what we'll perform for all subsequent metrics in the CampaignFX database.

Key finding #1: Audio helps to create future customer demand for brands

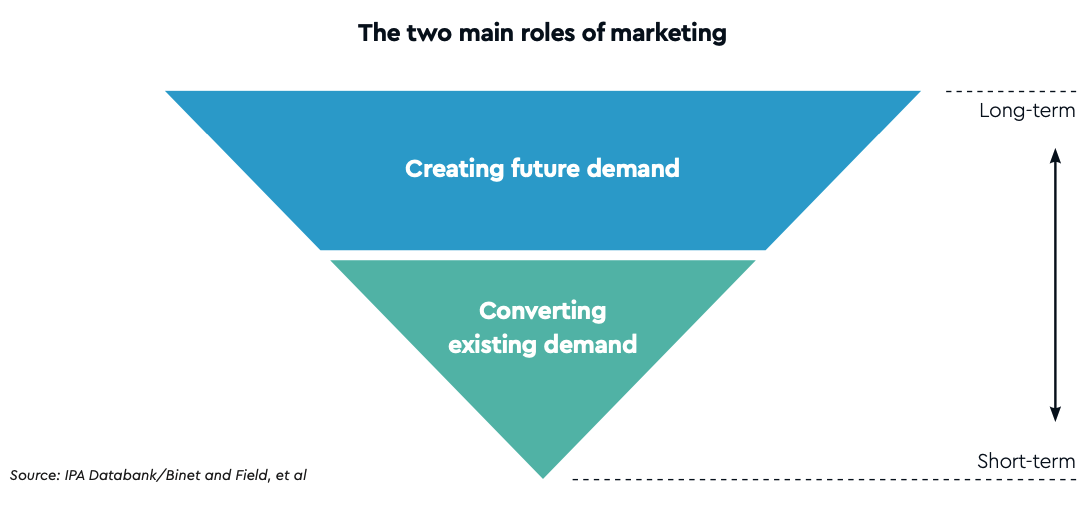

The first headline finding of this meta-analysis is that radio helps to create future customer demand for brands. Let’s explain this in detail. Thanks to the analysis of the IPA Effectiveness Databank conducted by Les Binet and Peter Field over the last decade, it’s now generally accepted that most successful marketing strategies use a mixture of long-term brand-building combined with shorter-term activation activity.

As the simple model here shows (source: Radiocentre UK, Big Audio Datamine), brand-building generally relates to ‘creating future demand’, which is a process that seeks to pre-prime future potential customers who won’t enter a market until some point in the near or distant future. Related to this, and moving down the diagram, we can understand ‘activation activity’ to be a process where brands aim to convert existing market demand by grabbing, hopefully, an unfair share of ready-to-purchase customers.

It’s within this context that our meta-analysis of CampaignFX data aims to help us understand the role that radio can play in both of the two main roles of marketing. Let's take a look at what the meta-analysis reveals about radio’s contribution to creating future demand. Here is the finding from our earlier example, which shows that Advertising Awareness is 26% higher for brands that advertise on radio.

The chart shows the 26% uplift in Ad Awareness for radio advertisers indexed against the baseline established by brands not using radio. Advertising Awareness is a crucial metric that measures the extent to which consumers are familiar with a brand’s advertising. This is reflected by the question we use, which asks “Have you seen or heard any advertising for these brands recently?”

Long term studies like Radiogauge in the UK have found that Ad Awareness seems to be particularly sensitive to the effects of radio campaigns, and it’s reasonable to ask why.

Historically, exposure to radio advertising has been shown to boost awareness of a brand's marketing activity across other media channels. This is often called radio’s ‘virtual TV' or 'virtual online video effect’, and we see clear evidence for that here. Most marketing theorists would agree that boosting advertising awareness across large audiences is a key objective for any brand, and our meta-analysis of the CampaignFX data demonstrates that radio is doing this very well.

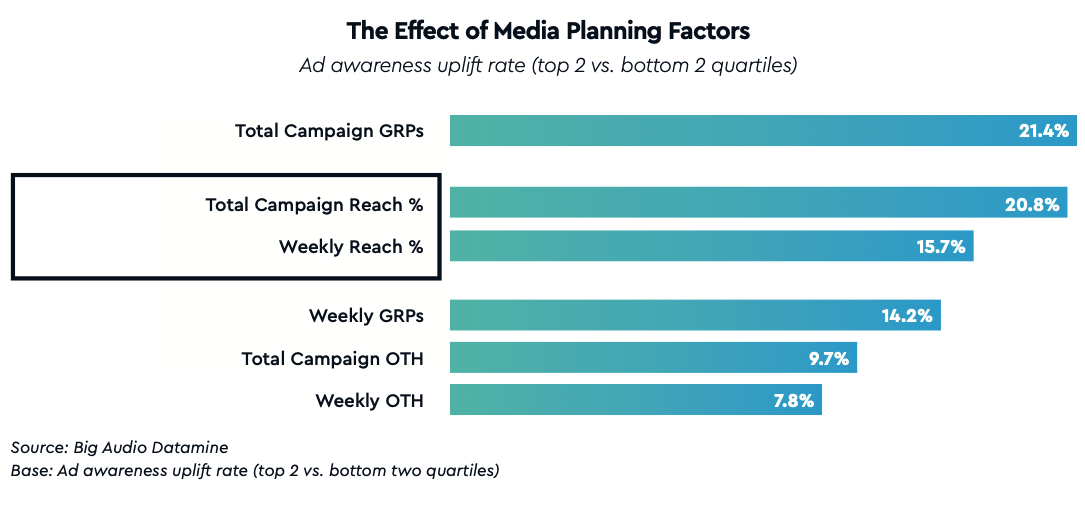

This finding is reflected by a key insight from Radiocentre UK’s Big Audio Datamine project. It looked at the impact of various media planning factors upon the growth of Advertising Awareness.

As the chart above illustrates, audience reach is clearly the driving force behind stronger ad awareness, and therefore campaign performance. This may seem surprising given that radio has historically been thought of as a frequency medium.

This doesn’t mean that ad exposure frequency has zero influence on radio campaign outcomes, but rather the its effect of frequency are far outweighed by the impact of building higher reach. And in a market like Ireland where it’s possible to achieve around 80% audience reach with radio in just one week, perhaps we shouldn’t be surprised by a 26% uplift in Advertising Awareness for brands using the medium.

In addition to the meta-analysis of CampaignFX data helping us to understand the significance of audience reach, it also enables us to review how audio advertising performs against a range of harder-to-shift emotional brand metrics that play a key role in creating future market demand.

Brand Likeability & Trust

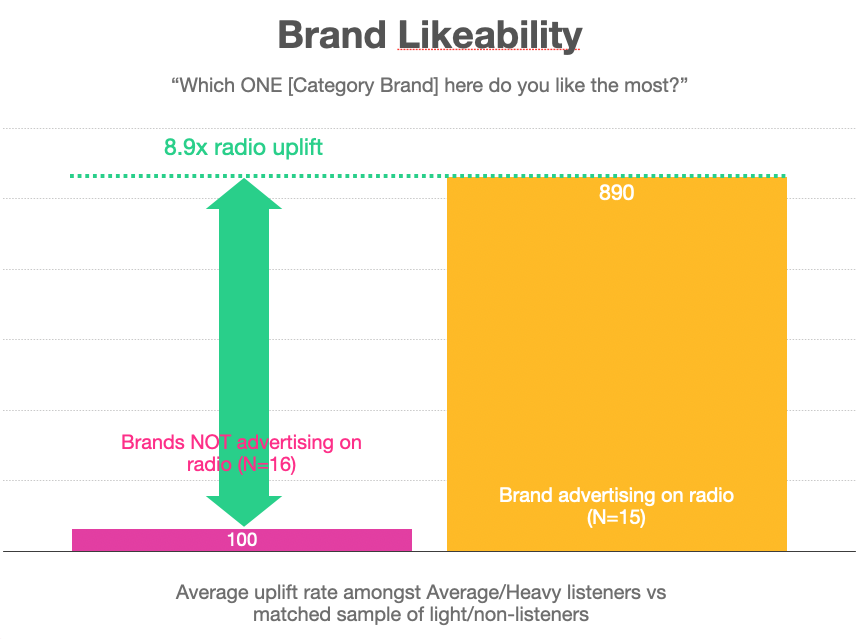

Brand Likeability is a useful proxy for the affection or preference consumers have for a brand, which in turn influences brand consideration and personal purchase decision making. Growing Likeability for a brand can be hard and it takes time, but our data suggests radio is an effective tool for the job.

To measure Likeability we ask survey respondents the following question: “Which ONE brand here do you like the most?” The response to this question yields a very clear picture. We found that Brand Likeability is on average almost 9x higher for brands using radio, which is great news for radio advertisers.

The gap in Brand Likeability between brands using radio and those not on air can possibly be explained by radio's unique ability to build feelings of intimacy between listeners and their favourite radio stations. This is evidenced by studies that show listeners often perceive listening to radio as feeling like spending time with a friend.

Our meta-analysis of CampaignFX data suggests that radio advertisers can benefit from this powerful audience relationship when they use the medium effectively.

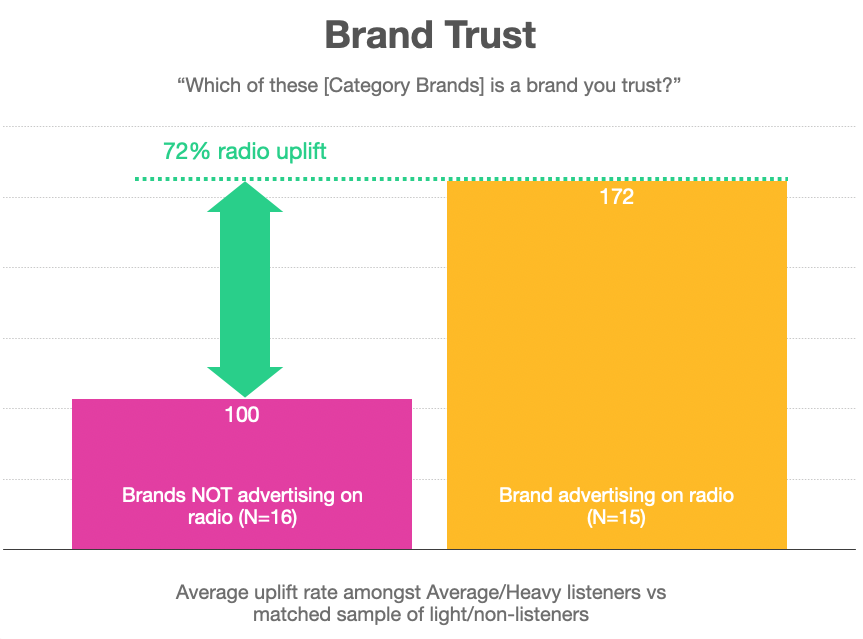

In a similar vein, we also see radio generating significant uplifts in Brand Trust, which plays a crucial role in the formation of the usually small brand repertoires that people will consider when making purchase decisions across a wide range of product categories.

Our question to survey respondents is simple: “Which of these brands is a brand you trust?” Across the 31 brands we collected data for, Brand Trust was 72% higher for brands using radio.

Again, this is good news for radio advertisers. Historical analysis of the UK's IPA Databank reveals that ad campaigns using radio as part of their media mix generate 4x the levels of brand trust compared to campaigns that don't feature radio. We usually take it as a good sign when independent research studies reflect each other’s findings and we’re pleased to see CampaignFX agreeing with the IPA Databank on this metric.

Key finding #2: Audio helps to convert existing customer demand

So far, the data has shown us how radio drives uplifts in awareness and how it can change the way people feel about a brand. All of this contributes to generating future demand by priming customers who are not yet ready to enter a specific market category but will likely make a purchase in the future. But what does the CampaignFX data reveal about radio’s ability to convert ‘existing demand’, or in other words, winning a purchase from consumers who are ready to buy today?

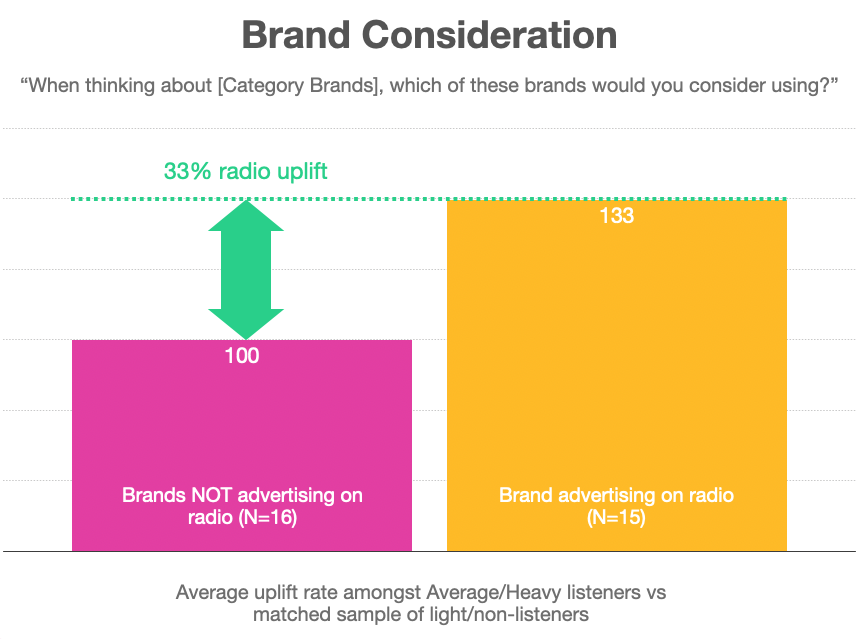

This leads onto the second key finding of the meta-analysis, which is that Radio helps to convert existing or active consumer demand. Our data helps us understand the ability of radio advertising to drive purchase consideration among active buyers.

Brand Consideration is a critical metric that bridges awareness and purchase intent. The question we use to capture this is simple enough: “When thinking about [brands in a specified category], which of these brands would you consider using?” Across the 31 brands we collected data for, Brand Consideration was 33% higher for brands using radio compared brands that had not been on-air.

This is an important finding for radio advertisers. When consumers consider a brand and their interest is piqued, they tend to seek more information. In today’s media environment, this curiosity usually drives people to search for specific brands online to learn about competitive offerings, reviews, prices, and other relevant details. We see strong evidence for this process at work in the CampaignFX data.

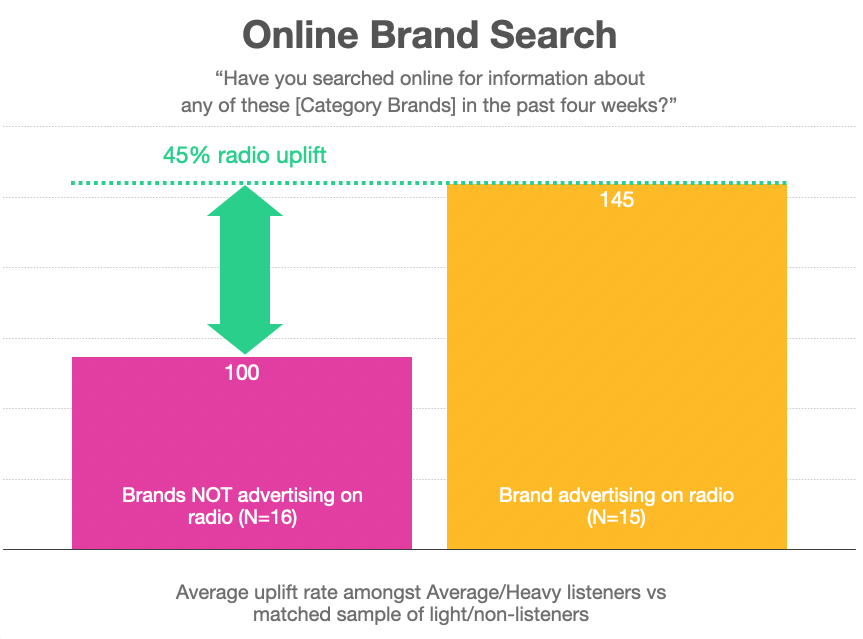

To understand advertiser-related online search activity we therefore ask the following question: “Have you searched online for information about any of these brands in the past four weeks?”

Across the 31 brands in our meta-analysis, we found that the uplift for Online Brand Search was 45% higher for advertisers using radio. Again, this is great news for brands using radio because it directly relates to Brand Purchase Intent, the final stage of the purchase process where consumers are ready to buy, and we’ll turn to this next.

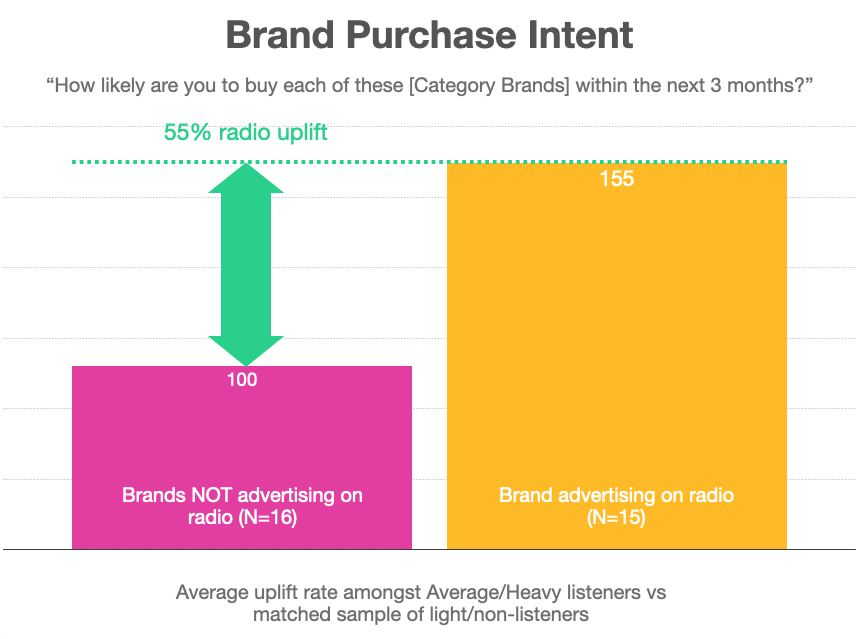

Brand consideration, as we just learnt, is about evaluating and comparing different brands as potential options, often marked by online exploration and information gathering. In contrast, brand purchase intent refers to making a concrete decision to buy something. This is when consumers become focused on taking action and are ready to make a purchase. We capture this intent by asking the question, ““How likely are you to buy each of these Brands within the next 3 months?”

Our meta-analysis of CampaignFX data found that brand purchase intent was 55% higher for brands using radio advertising. This means radio is an effective way to encourage in-market consumers towards a final purchase, often by helping people reach a positive emotional decision about their final brand choice. The probability of radio achieving this outcome tends to be increased by appreciating the insights gained from our third key finding headline.

Key finding #3: The best performing radio campaigns optimise audio creativity

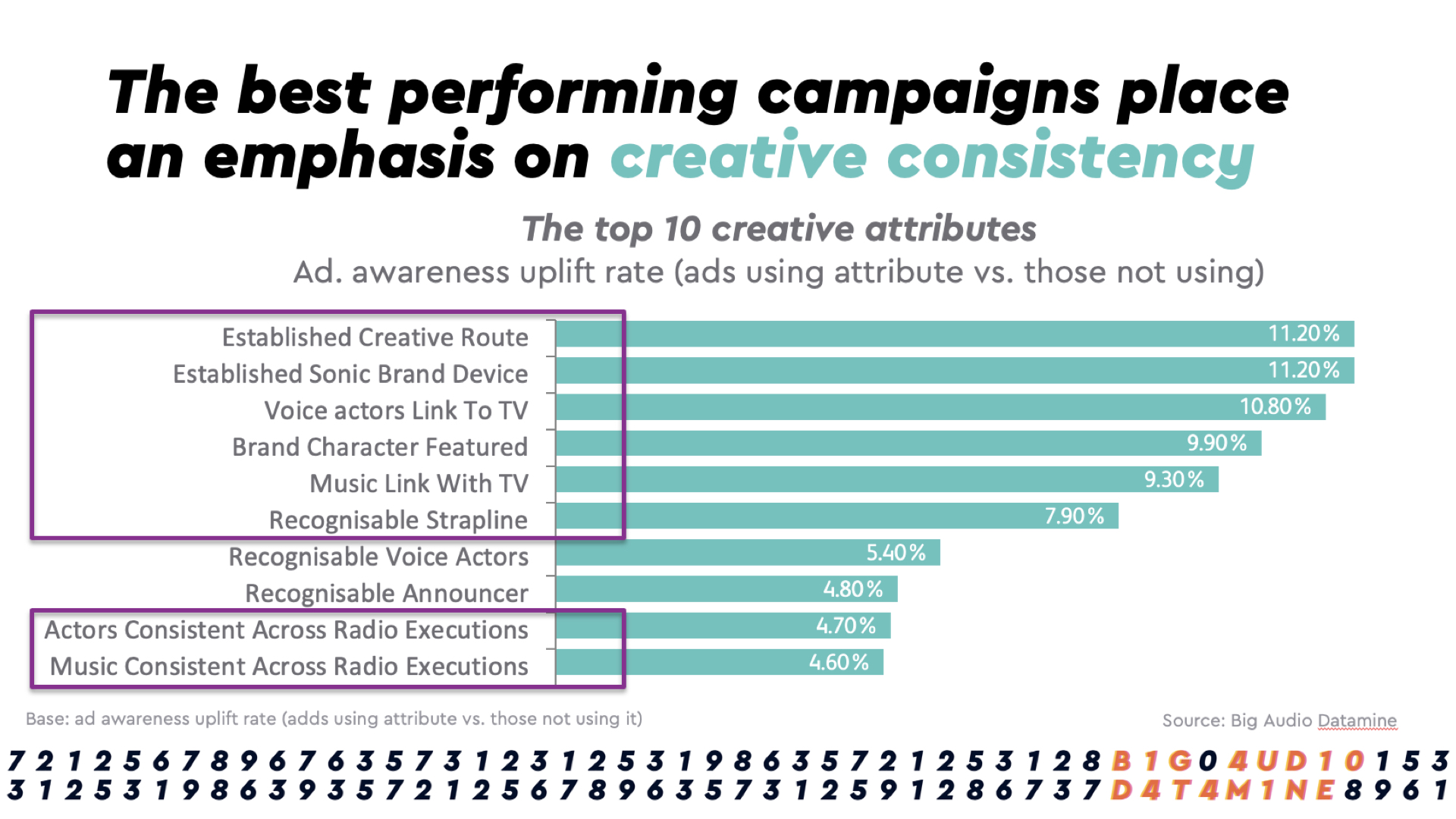

A key discovery of Radiocentre UK’s Big Audio Datamine project was that eight of the top ten creative attributes found in radio adverts related to developing consistent audio elements. You can see these creative attributes in the chart here. They include music, voices, straplines, brand characters and sonic brand logos. But crucially it was found these devices had to be deployed consistently over a long period of time across all of a brand’s successive radio campaigns AND the audio-visual content produced for media like TV and online video.

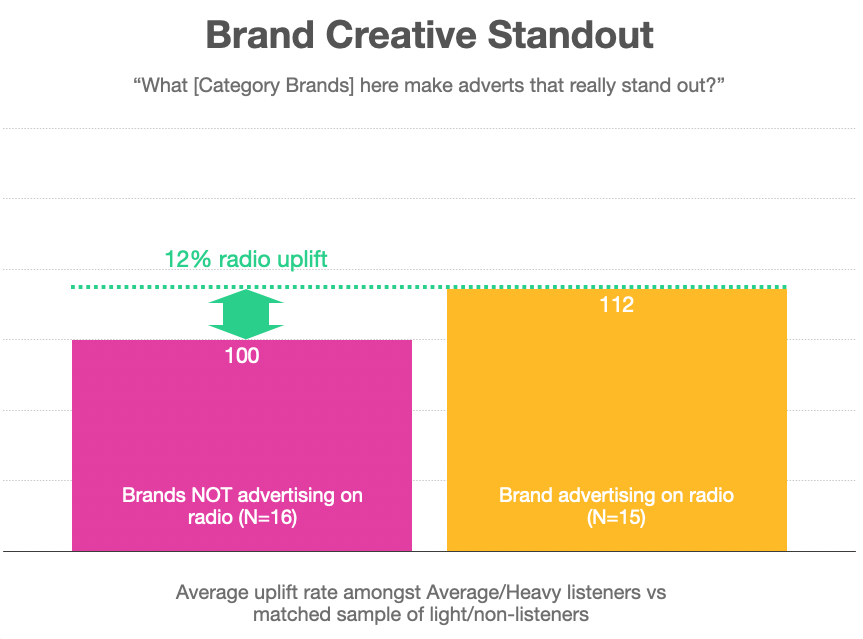

Although we don’t have all of the audio creative meta-data available to the Big Audio Datamine analysis, CampaignFX has yielded one important finding that reflects these insights. Creative Standout, or the distinctiveness of ad creativity, measures how well a brand’s advertising captures attention and differentiates itself from competitors.

Within an audio context, consistent use of both distinctive and familiar sonic branding assets is by far the best way to get noticed and remembered by listeners. To capture this effect we ask survey respondents, “What brands here make adverts that really stand out?” - notice that we don’t specific adverts in any specific medium or channel. Across the 31 brands represented in the CampaignFX database, Creative Standout turned out to be 12% higher for brands using radio advertising.

This is a fascinating finding that begs the question, “why might audio advertising enhance perceptions of a brand’s creative standout across all advertising channels?” We think the previous insights from BIG Audio Datamine can help provide an answer.

Radio is a medium that relies solely on audio, which can lead brands to develop strong, memorable auditory cues for their ads. These audio elements, when used consistently, become deeply embedded in listeners’ memories. When these familiar audio cues are then used in TV and online video content (or perhaps visa versa) , they trigger recognition and recall, enhancing the overall impact of the adverts across all media. We therefore think that radio serves as a foundational platform for building and reinforcing a brand’s distinctive audio identity, which then elevates a brand’s visibility and distinctiveness across all channels.

Radio's role as a foundational platform for audio creativity can play a significant role in growing a brand’s mental availability. Famously defined by Bryon Sharp and his colleagues at the Ehrenberg Bass Institute, Mental Availability refers to the likelihood of a brand being thought of in a buying situation. This is driven by a brand’s presence in the minds of consumers across various category entry points (CEPs).

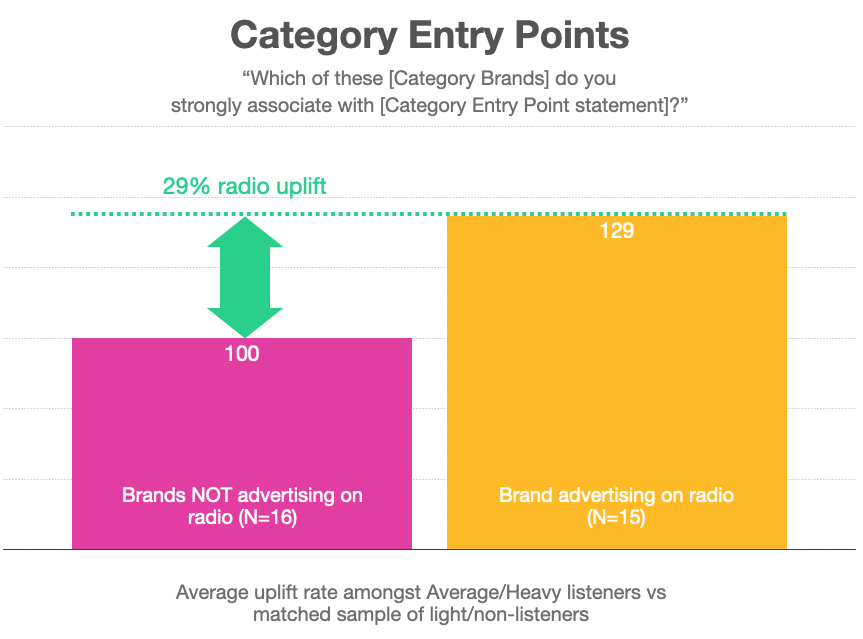

CEPs are situations or needs that trigger the thought of a brand. By using consistent and distinctive audio elements, brands can effectively embed themselves in the mental frameworks of consumers and we see strong evidence for this occurring in the CampaignFX data. The 5 survey waves that comprise our total dataset deployed a set of 8 category entry point questions that defined the key consumer needs specific to each brand category.

The basic structure of the CEP questions was the same for each category and began as follows, "Which of these brands do you strongly associate with..." - and this was followed by an appropriate category entry point statement.

Our meta-analysis reveals that on average, brands that were advertising on radio were 29% more likely to be associated with relevant category entry points than brands that were not advertising on radio. This is a tremendous result. It demonstrates that brands can significantly enhance their creative standout and mental availability. This is achieved by using radio as a foundational platform to develop and consistently reinforce a brand’s distinctive audio identity over time across a wider range of media channels.

Summary

So far as we're aware, CampaignFX represents the biggest combined analysis of audio advertising effectiveness ever undertaken in Ireland. It comprises data on the top 31 brands within Ireland across 5 key advertiser categories, specifically Personal Banking, TV Streaming, Fast Food, General Insurance and Health Insurance. This has been achieved by developing a new category-led approach to high quality audio effectiveness research that is financially sustainable over the long term in small and mid-sized media markets.

The meta-analysis of the Irish CampaignFX data demonstrates how audio advertising creates future demand for advertisers by generating a 26% uplift in ad awareness, which makes consumers more familiar with a brand. Radio advertising improves brand likeability by a factor of almost 9, and boosts brand trust by 72%, thanks to its unique ability to build intimate relationships with listeners.

Thanks to this meta-analysis, we now understand far more about radio's ability to convert existing market demand. The data shows that audio advertising generates a 33% uplift in Brand Consideration, effectively moving consumers from awareness to purchase. We also found that audio advertising leads to a 45% increase in online brand searches, thereby prompting listeners to seek more information online. This in turn is related to the 55% uplift in brand purchase intent we discovered for brands using audio.

And finally, creative standout is 12% higher for brands using audio, meaning that radio often serves as a foundational platform for building and reinforcing a brand’s distinctive audio identity, which in turn elevates a brand’s visibility and distinctiveness across all other media channels.