"Colourtext always take a fresh approach to discovering hidden patterns in data. Whether you want to conduct segmentation or mine your CRM for deep insights, they will help you see your customers , and what they are seeing , in new ways."

The UK’s most comprehensive study of radio advertising’s relationship with online search behaviour and website traffic growth.

'Radio: The Performance Multiplier' is the UK’s most comprehensive study of radio advertising’s relationship with online search behaviour and website traffic growth. Developed by Radiocentre in partnership with Colourtext, the study sets out to meet the challenge of offline media attribution. It presents exciting new opportunities for brand owners to optimise their performance marketing efforts.

Offline media struggles with a significant attribution challenge. The core issue is the difficulty of directly linking offline exposure, such as radio and TV ads, to online responses and conversions. Online media benefits from digital tracking technologies, specifically tracking cookies. These allow for precise last-click attribution, providing clear data on user interactions and conversions. This (contested) direct link between exposure and response is what offline media struggles to replicate.

Within the context of performance marketing, TV advertising has benefited from methods that analyse web traffic peaks within a 20-minute post-transmission period. This short-term response window offers a glimpse into the immediate effect of TV ads. However, when short-term response windows are applied to radio the results suggest audio underperforms compared to TV and other channels.

This experience runs counter to the findings of long term effectiveness studies like Radiogauge, which suggest there are good reasons to believe that radio ads can have significant influence over consumer online behaviour. We took this as a sign that standard web attribution techniques might be ill suited to measuring the response performance of radio campaigns and that a better approach could be developed.

Solving the Problem of Web Attribution for Radio: A New Approach is Needed

According to IPA Touchpoints, nine out of ten radio listening occasions occur while listeners are engaged in parallel tasks. It's crucial to acknowledge the multitasking nature of radio listening because it affects immediate response rates when compared to media requiring focussed attention, such as TV and social media. Put simply, it's reasonable to acknowledge that listeners tend not to swerve their cars into the nearest lay-by to respond immediately to ads they hear on the radio.

Our core hypothesis was that in most situations radio ads tend to give rise to a delayed web response rather than no response at all. We guessed that listeners often act on the ads they've heard but usually at a later, more convenient time. Based on this chain of reasoning, we expected that firm evidence of a delayed response factor would overturn the conventional wisdom of relying on short-term attribution windows to capture the response effects of radio advertising.

When considering the best research methodology to adopt for this project we needed an approach that could accurately capture an offline medium’s online response, that was likely to be delayed over a yet-to-be determined period of time and probably delivered through a wide range of web traffic referral channels (e.g. organic search, PPC, social, display etc.)

We identified regression modelling as the most effective – potentially the only – technique to address the core methodological challenges of this project. To ensure the credibility of our findings we knew the project analysis would have to be grounded in real-world data from in-market campaigns.

Four multimedia advertising campaigns that used radio were analysed in detail for this study. This was a self-selecting sample that consisted of brands from a diverse range of businesses, each placing significant investment into Demand Generation media. The total aggregated media spend across the four campaigns during the timeframe we analysed was £3.2m, with TV/BVOD and Radio/Digital Audio accounting for over three-quarters of total spend.

It’s important to acknowledge the depth of data generated incorporated into this study. Across the four campaigns, the analysis of daily multi-media impacts vs. daily web sessions encompasses the effect of 1.6 billion multi-media impacts on 30 million web sessions. Similarly, the one-week analysis of minute-by-minute radio-time-lag-related data incorporates 40,320 time-based data points - exploring the relationship between 152 million radio advertising impacts and 2.1 million web sessions.

To correlate multi-media impacts (the independent variables in our analysis strategy) with web sessions (the dependent variable we had to explain), Colourtext developed a suit of self-tuning multiple regression models. The models required two extremely detailed datasets from participating campaigns to in order to support an accurate analysis. The first dataset was exported from Google Analytics and comprised daily web session volumes for a brand's website, segmented by referral source. The second dataset included media schedule and campaign spend details. This encompassed All Adult impressions by medium by day and total spend by medium by week, covering the entire radio campaign period and at least two weeks pre- and post-campaign.

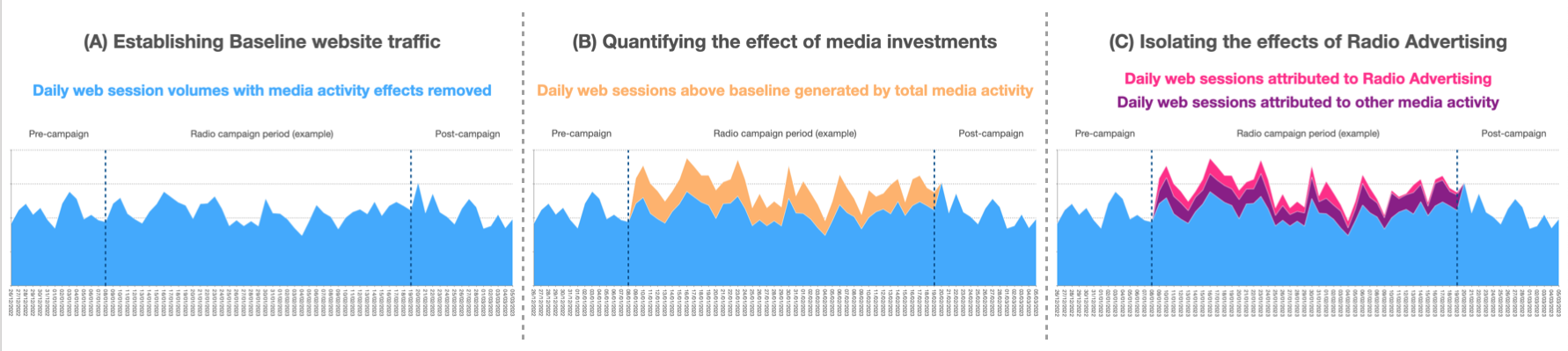

In broad terms, the regression modelling process illustrated in the charts above establishes (A) a baseline level of daily web sessions during a radio campaign period. This represents what website traffic levels would have been if no demand-generation media activity had occurred. The baseline traffic analysis provides a reference point for assessing the web response impact of all media investments that we have data for.

The model then computes (B) the total media-driven uplift in web sessions generated during the radio campaign period. This step reveals the collective impact of all media activities on driving the growth of web sessions above a brand's baseline traffic level. Finally, the model isolates (C) the effect of each advertising channel on website traffic growth. This computes the proportion of the total traffic uplift attributable to radio, which allows for a accurate measurement of radio's specific impact within the broader media mix.

In order to capture radio's delayed response, we used seven days of minute-by-minute data for both datasets, representing a typical week within the overall radio campaign period. By using a self-tuning adstock function, our regression model was able to analyse the minute-by-minute relationship between web sessions and radio advertising impacts. This tested our delayed radio ad response hypothesis by analysing the time lag between a radio spot airing and the realisation of its full response potential.

Key Finding #1: Regression Analysis Reveals Radio's Full Ad Response Impact

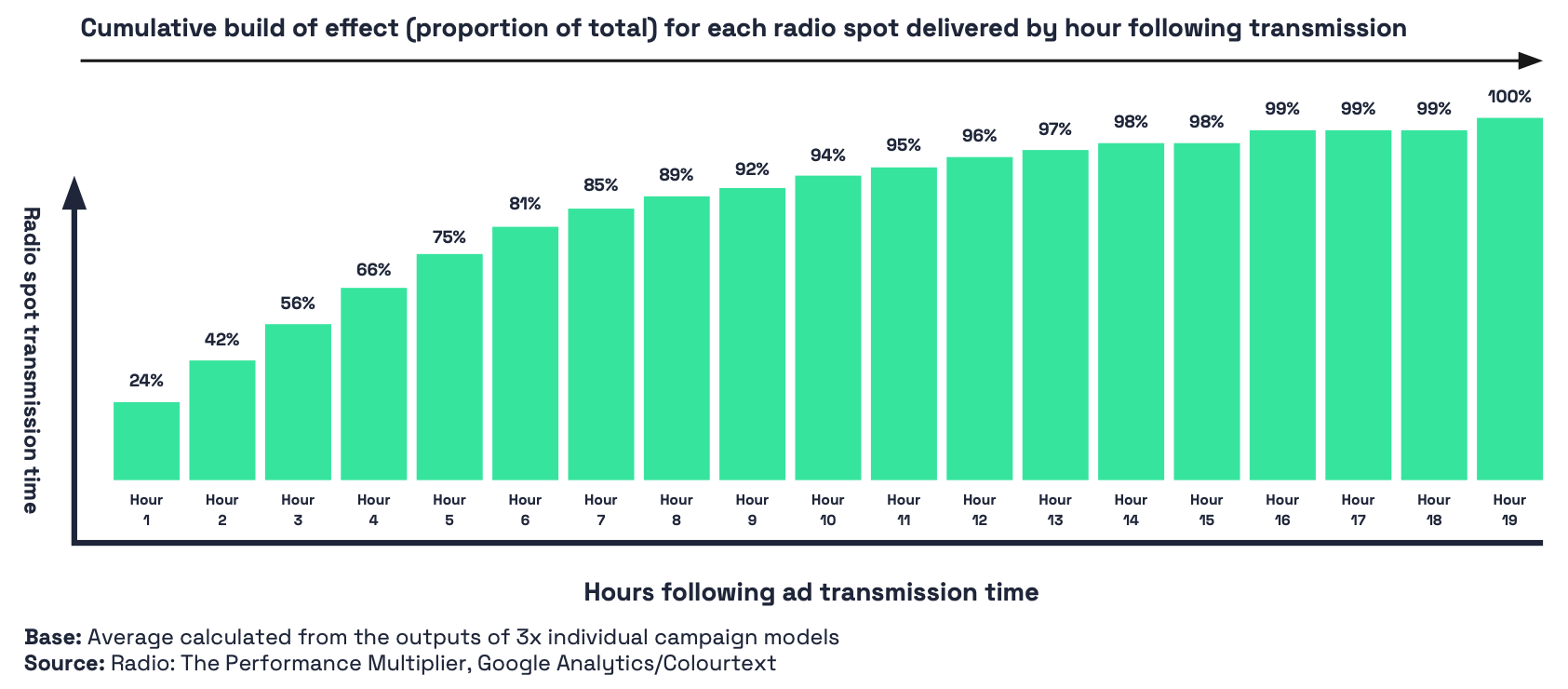

Based on the regression model using the self-tuning ad-stock function to analyse the strength of the relationship between web sessions and radio advertising impacts on a minute-by-minute basis, Colourtext explored the time lag between a radio spot being transmitted and the time that elapses before it reaches its full response potential.

The chart above shows the cumulative build of effect for an average radio spot delivered by hour following its transmission, expressed as a proportion of its total potential effect, revealing how it takes 19 hours for the full effects of each radio spot to be realised. This is based on the average taken from the three campaigns in the study which demonstrated almost identical results, meaning that we can be very confident in the reliability of this finding (for clarity, the fourth campaign - a relative outlier - demonstrated a slightly greater time lag).

Key Finding #2: Short-Term Attribution Windows Fail to Capture Nearly all of Radio's Ad Response

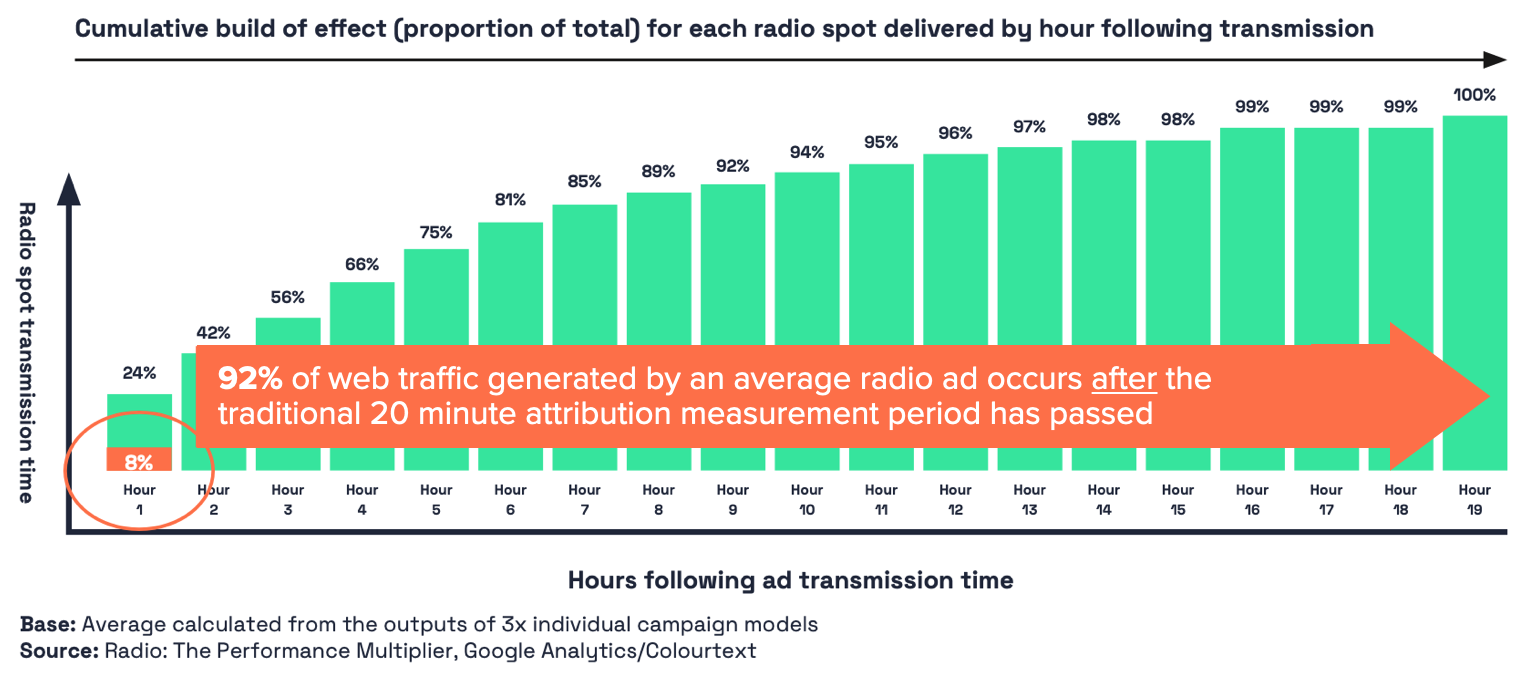

The implication of this finding is profound. As the chart above highlights, only 24% of total potential ad response effect is delivered in the first hour following a spot’s transmission. Based on this finding, if an attribution system only considers ad response generated in the first hour after transmission it excludes around 76% of radio advertising’s full contribution to web traffic growth. However, the situation tends to be even more serious than this.

Let's recalls that the typical response window for short-term attribution measurement is 20 minutes. Further analysis by Colourtext reveals that just 8% of radio advertising's full response potential is realised within the first 20 minutes after ad plays out. This means that typical short-term attribution methods fail to capture a massive 92% of radio response effect. Short-term attribution measurement significantly underestimates the level of radio ad response, which has led to a significant opportunity loss for performance marketers.

Key Finding #3: Radio Makes a Significant Contribution to Website Traffic Growth

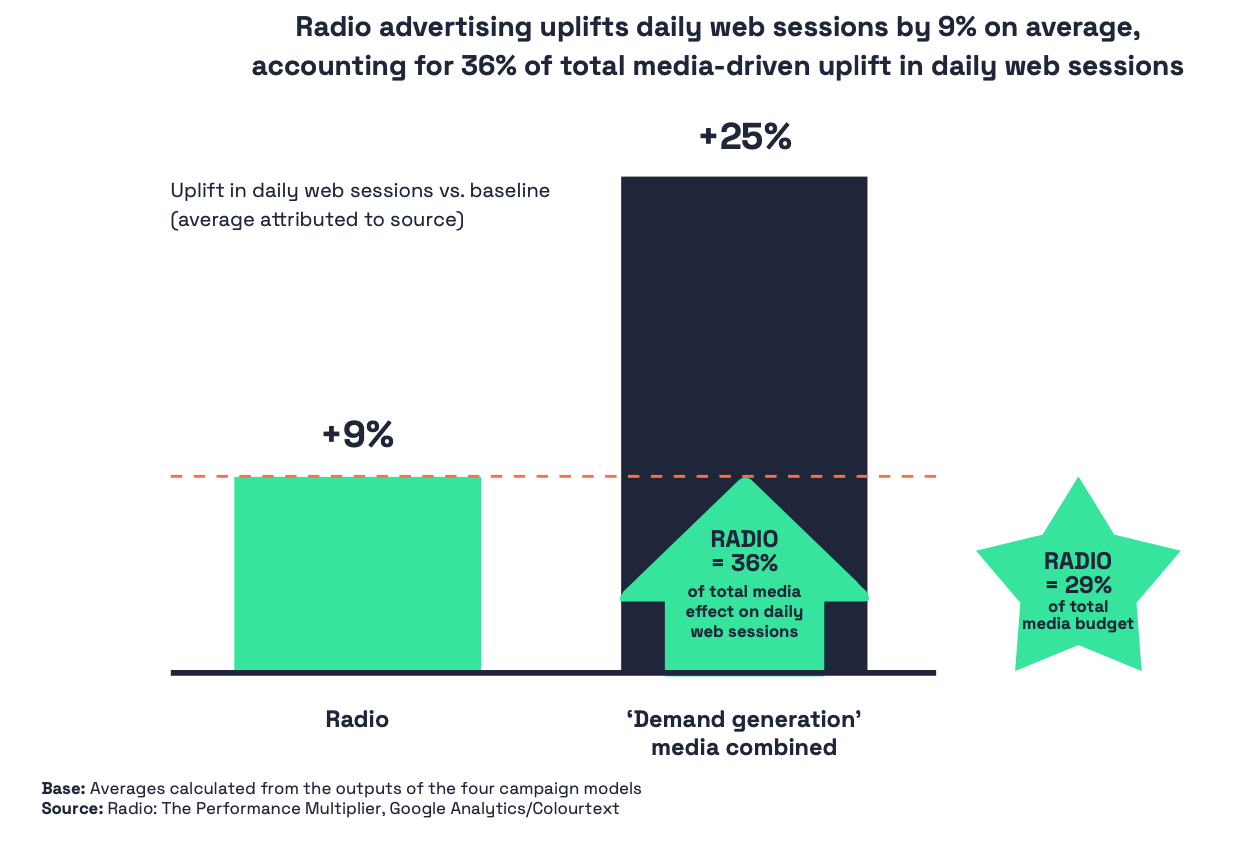

The regression analysis exploring the relationship between daily multi-media impacts and daily web sessions for each of the participating advertisers; on average radio advertising drove an uplift of 9% in daily web sessions across the four campaigns. To put this into context, across the same four campaigns, all demand generation media combined drove an average uplift of 25% in daily web sessions. Beyond demonstrating the efficacy of demand-generation media in general, this also means that, on average, radio advertising accounts for 36% of the total media-driven uplift in daily web sessions.

To put this into further context, the analysis of spend by medium across the participating campaigns highlights how radio (including digital audio) accounts for 29% of their aggregated media spend. Comparing radio’s proportion of total effect (36%) to its proportion of total spend (29%), hints at the potential cost-efficiency that radio advertising can bring to performance-based media plans.

Key Finding #4: Reallocating Media Budget to Radio Boosts Web Traffic Across a Range of Referral Channels

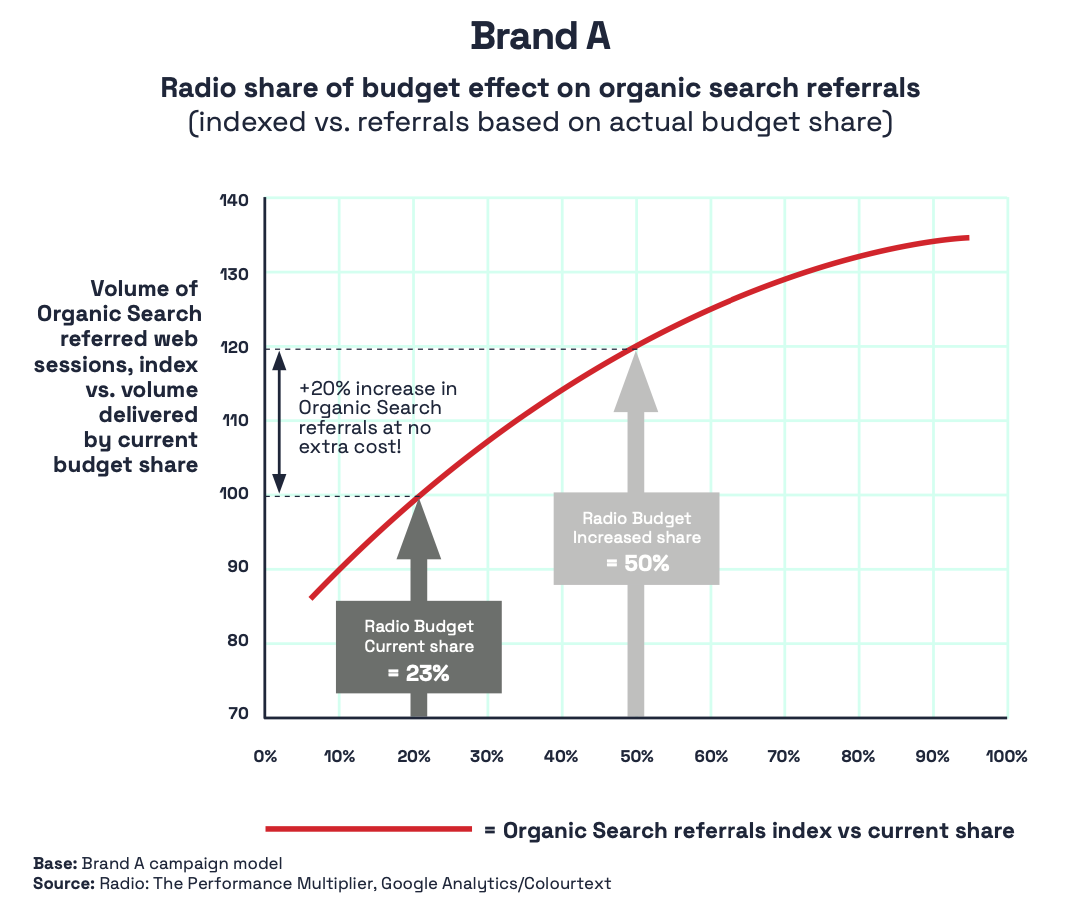

Across one of the four brand campaigns we studied, the regression modelling revealed that radio advertising can have a significant impact on the organic search behaviour of consumers. This is significant because organic search can be the largest source of web traffic referrals for many branded websites, often accounting for around two-thirds of all visits. Our modelling shows that if a campaign budget remains fixed but radio’s share of ad spend is increased from this study’s 23% to 50%, organic search traffic can be expected increase by around 20% at no extra cost to the advertiser.

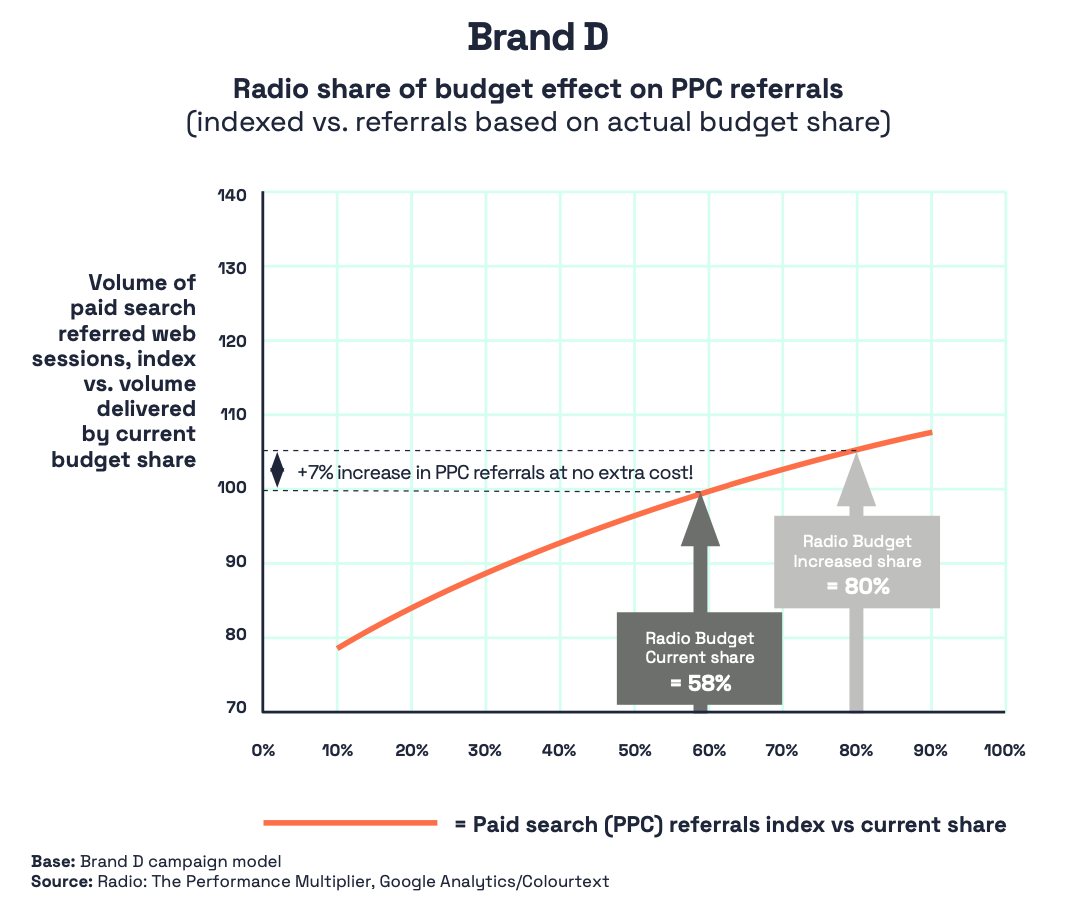

The modelling also shows that radio advertising has a significant influence on people's interaction with paid search links. This is significant because Pay Per Click (PPC) search is a highly competitive investment channel for many brands that are fighting to win a share of in-market purchasers. Radio advertising not only appears to stimulate search behaviour within a brand category but also increases brand-specific click-through-rates for PPC impressions. Our model found that despite Brand D already investing a high share of budget into radio (60%), increasing this even further to 80% would still generate a 7% uplift in Paid Search volumes at no additional media cost to the advertiser (simply by reallocating budgets from other demand-generation media).

Summary

The study demonstrates how current attribution methods exclude 92% of Radio advertising’s true effect. Brands that use short-term response windows will not be able to get a proper handle on how radio is working within a performance marketing campaign context (and you’re probably hugely underestimating TV’s effect too!)

This study categorically shows that when brands do capture radio’s full effect it proves to be a highly valuable part of the performance marketing mix. On average, radio boosts daily web sessions by 9% - and twice as cost-efficiently as other ‘demand-generation’ media combined.

Radio’s indirect response effect boosts response via pureplay performance channels (search & social). In this context, increasing radio’s share of the media budget is demonstrated to enhance overall performance efficiencies at no extra cost.

Radiocentre has produced a full range of project resources for Radio: The Performance Multiplier. These include a definitive PDF report, PowerPoint slide deck and the video of our launch seminar: