"Colourtext always take a fresh approach to discovering hidden patterns in data. Whether you want to conduct segmentation or mine your CRM for deep insights, they will help you see your customers , and what they are seeing , in new ways."

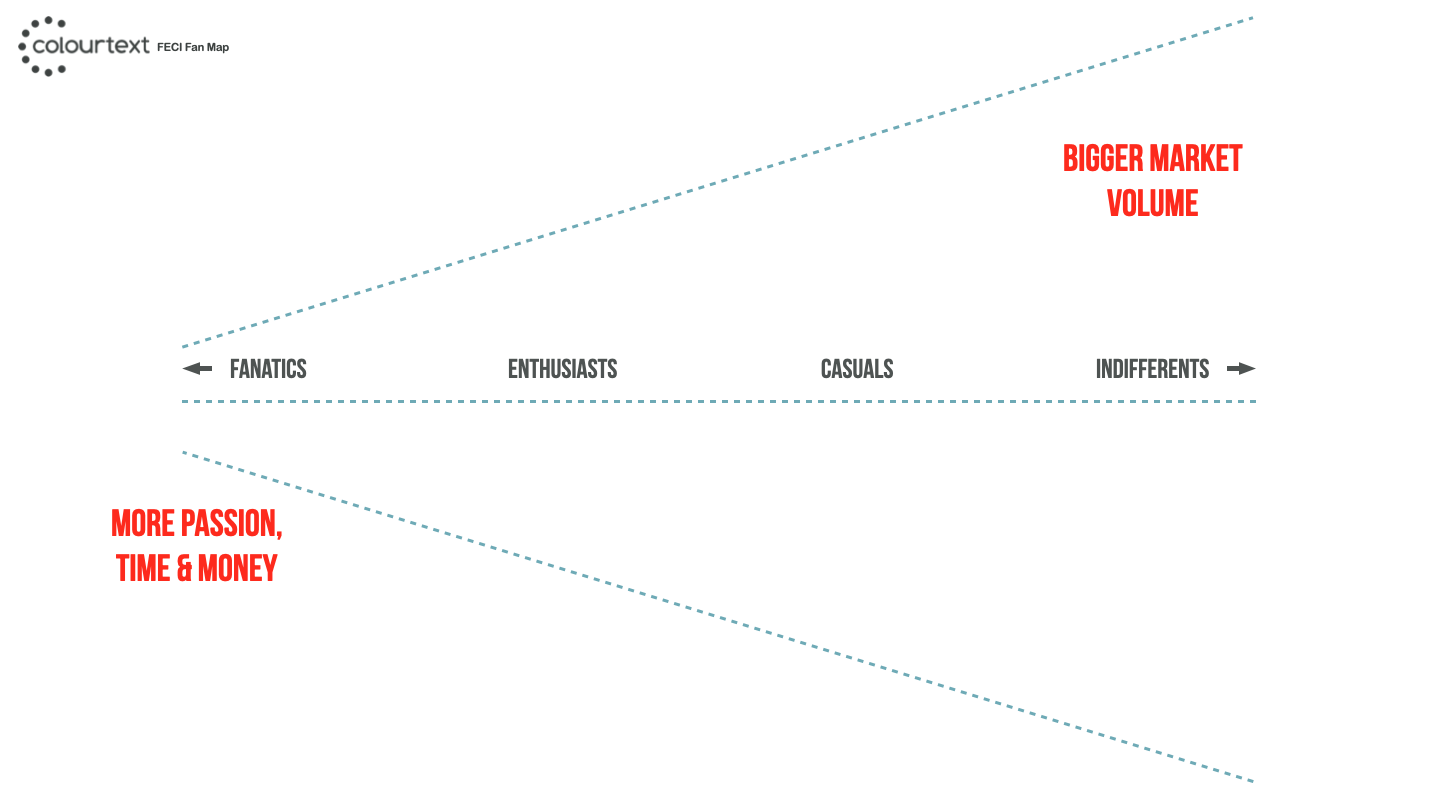

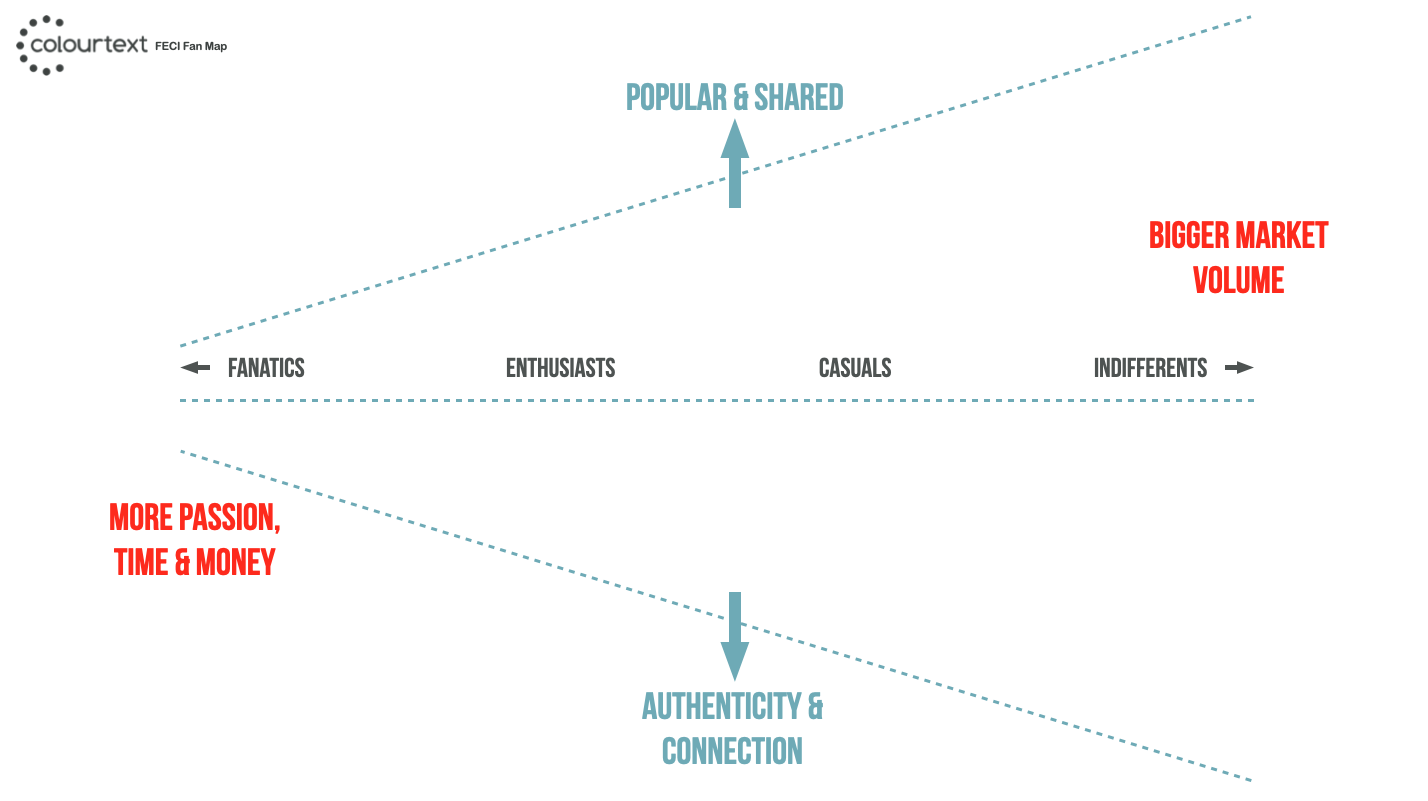

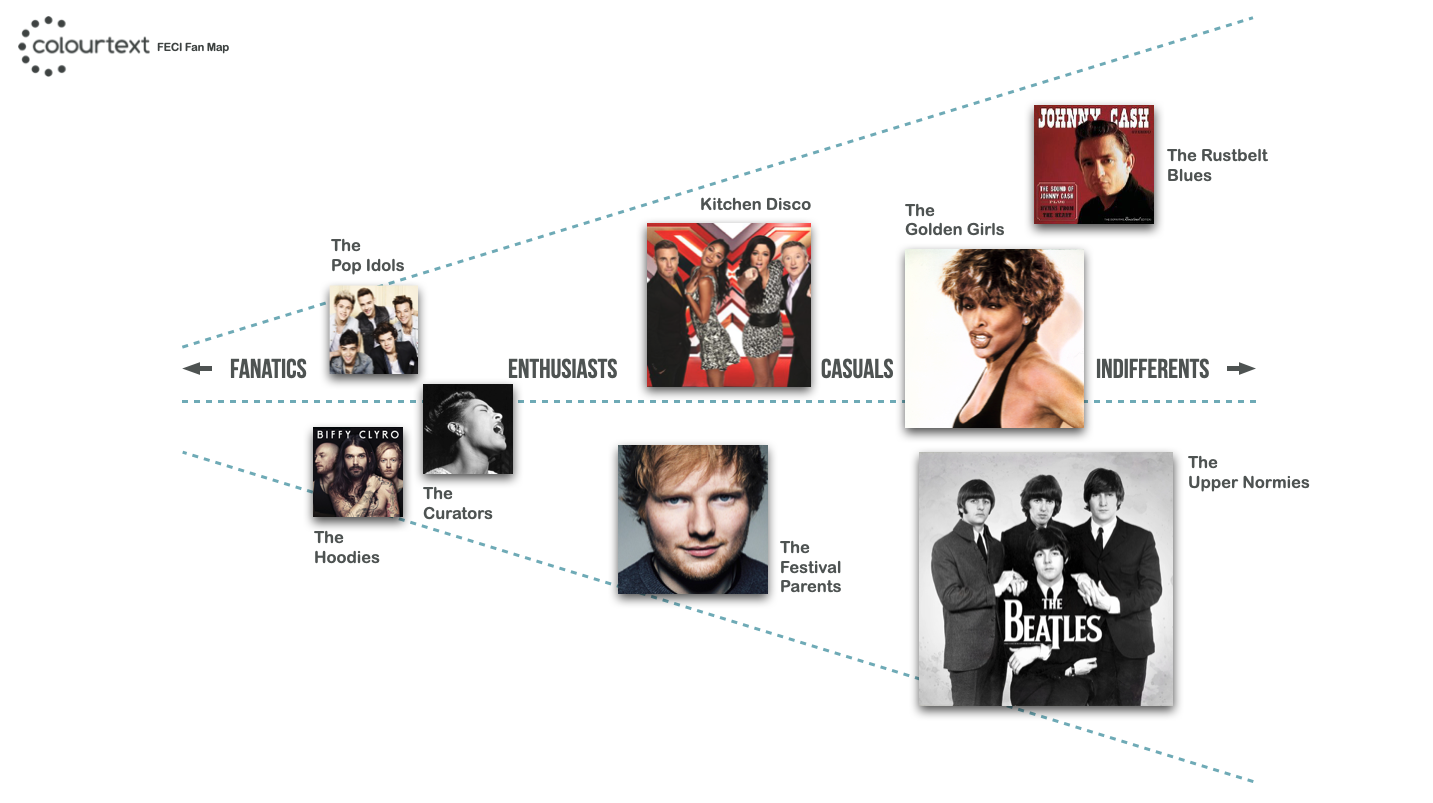

The FECI Fan Map is a powerful way to explain any market by segmenting consumers into Fans, Enthusiasts, Casuals and Indifferents.

FECI is an acronym based upon the names of 4 broad archetypes found in a lot of consumer-facing sectors - Fanatics, Enthusiasts, Casuals and Indifferents.

It's a market segmentation method that positions consumers on an intuitive Fan Map to predict how much time, effort and money a potential customer is likely to invest within a specific market or field of interest. FECI segmentation takes careful account of the cultural and lifestyle disposition of a consumer, their appetite for new information and level of innate interest or market knowledge prior to making a purchase decision.

The analysis process is driven by data from a wide range of sources including 1st party, market research, CRM, web content and social media. FECI segmentation establishes an intuitive Fan Map of market personas that provides nuanced and highly predictive explanations of consumer behaviour.

To understand the first principles of FECI segmentation let's use the world of pop music as an example (see also a FECI Fan Map of Foodies here). Imagine a horizontal axis that represents how 'engaged' anyone can be with music. At the left hand side of the axis are 'The Fanatics' - people who invest almost crazy amounts of time, effort and money into their relationship with music.

At the opposite end of the Fan Map's central axis we find 'The Indifferents' - people with little or no interest in music whatsoever. The Casuals and The Indifferents purchase less frequently and spend far less per head than The Fanatics and The Enthusiasts, but thanks to their big population size represent a valuable high-volume market of light and irregular customers.

At a broad level The Fanatics are relatively small in number but represent the heaviest, most committed and profitable type of music consumer out there. Now, let's imagine three different sub-groups of music Fanatic.

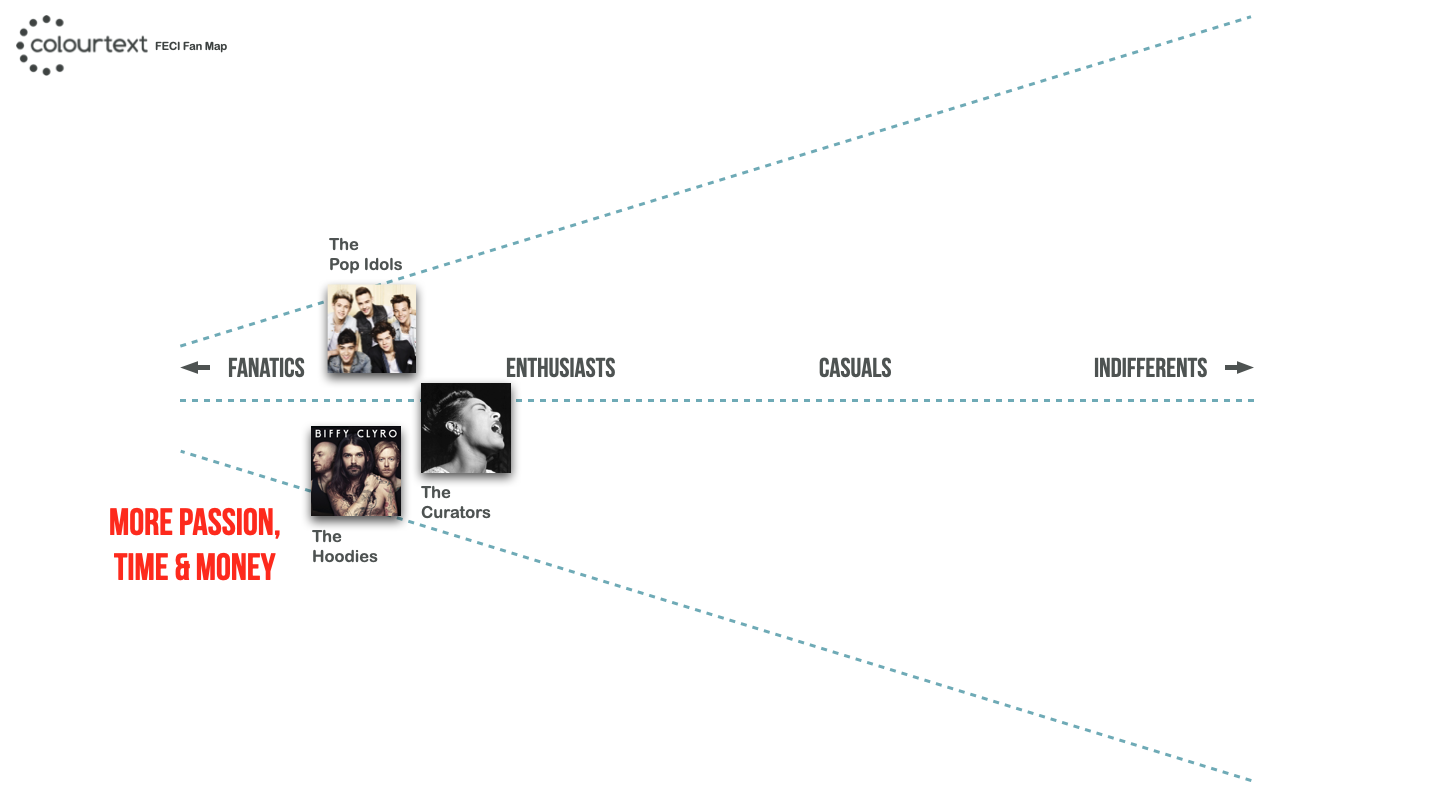

At this point you might think these 3 sub-groups are essentially the same people representating a macro segment of "heavy" or "passionate" music consumers. That would be true of course, but FECI segmentation provides a lot more texture and insight. Let's call one of our groups The Hoodies, another The Pop Idols and the last one The Curators.

The Hoodies are passionate about rock music with attitude and feel a deep antipathy towards the silicone dolls of the manufactured mainstream. Credibility is key for members of this group; they value people or things that are ‘real’ and ‘authentic’ and reject anything tainted by the whiff of ‘hype’. They are quick to express deeply felt opinions, wear emotions on their sleeves and both their music and fashions are intentionally loud and challenging.

The Pop Idols are totally star-struck teens who are literally obsessed with the biggest pop acts of the day. Emotionally expressive and intensively protective of their cherished icons, their devotion to a favourite artist or boy band knows no limits. They will go to almost any lengths to prove they are the most passionate and fervent fans in the world.

The Curators tend to be guys approaching middle age who are self-declared connoisseurs. Music has always been at the centre of their world and tends to define their memories and identity. Although the responsibilities of age don’t allow them go clubbing or attend gigs as often as they once did, their passion is undimmed and has translated itself into a collector's mindset. The musical interests of The Curators tend to reflect backwards in time and they are keen to fill any remaining gaps in their collection.

Next to The Fanatics on the FECI Fan Map are The Enthusiasts. A passion or interest like music is a key part of life for this group but they're not so obsessive as The Fanatics. Enthusiasts in a category tend to be polymaths with a diverse range of interests who like to be firmly plugged into several passion-fields or brand categories at once rather than wholly committed to just one.

Enthusiasts love to get in early on new ideas, trends or innovations that gestate within the Fanatic community, which means they often play an crucial role in ‘translating’ these trends for the mainstream. Enthusiasts are second only to Fanatics in terms of the time and money they invest in a brand category.

Compared to Fanatics, Enthusiasts tend to be less ‘purist’ in their tastes. They are happier than Fanatics to engage with a broader mainstream offering, if only at a knowing or ironic level. And they tend not think of their category purchases as forming a ‘collection’ (as the Fanatic might) but more as a form of social signalling.

The Mainstream Market

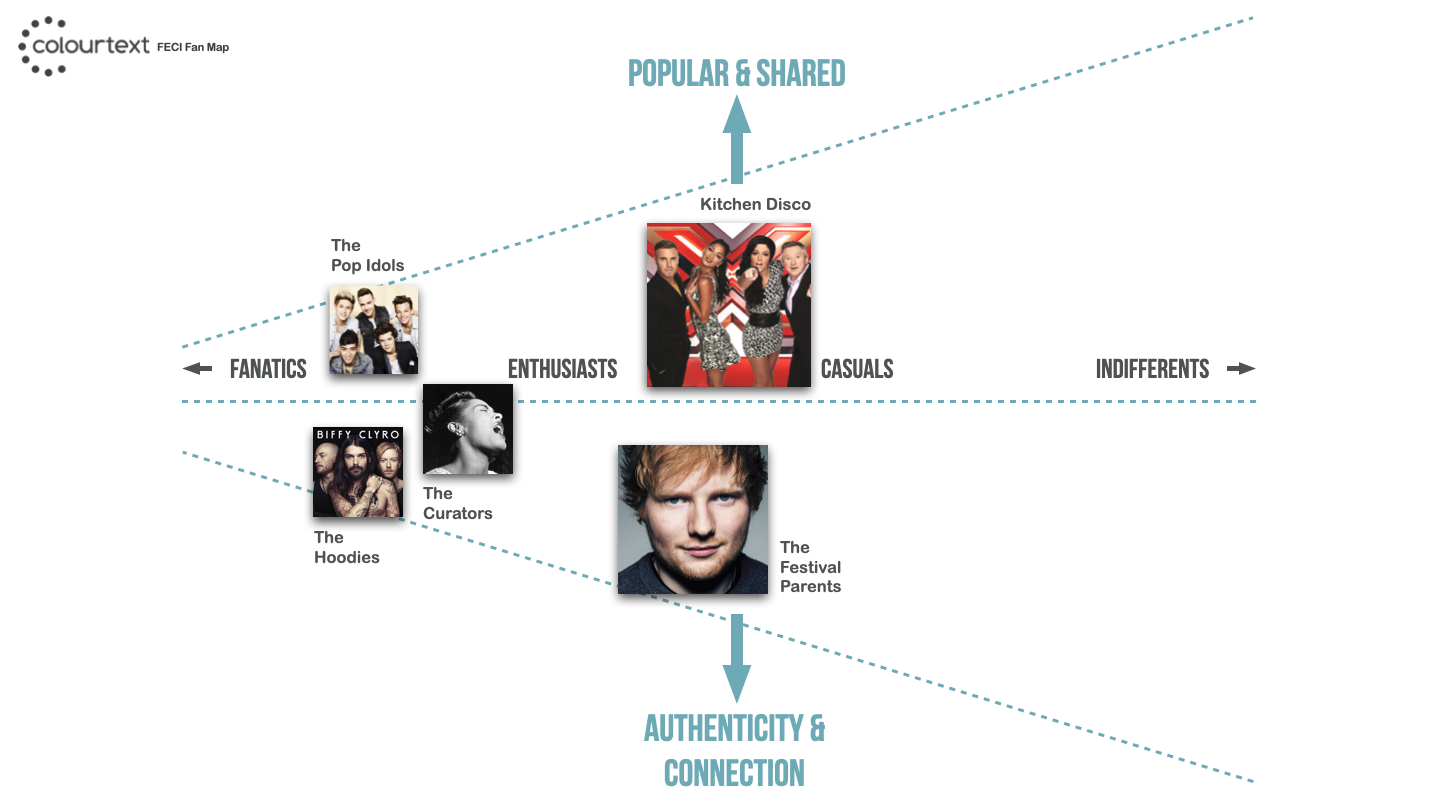

We can now see that each of our Fanatics belongs to a distinctive tribe whose relationship to music is driven by different personal motivations and life circumstances. The FECI Fan Map respects these differences and makes them easy to see and appreciate. But the Fan Map also helps us understand why a group is positioned above or below the central axis line. To understand how FECI segmentation positions groups along the vertical dimension of the Fan Map let's take a look at two Casual groups within the middle ground.

The Festival Parents have busy lives with multiple family and career responsibilities. Music has a real influence on their lives because it helps them define moods and complement different occasions – they know what a perfect Sunday morning record sounds like. When they get a moment to relax they want to be their real selves, which means they're looking for leisure with content. In musical terms this means experiences that feel spiritually rewarding or have intellectual resonances. They dislike pop because it’s perceived as cheesy, manufactured and over-played. This means they tend to reject anything that appears too mainstream but on closer examination most of what they listen to has actually featured in the charts at some point.

The Kitchen Disco group are regular fun loving parents who still feel young at heart and refuse to be left behind by fashion and modernity. Despite busy lives that revolve around work and family they don't want to be pigeonholed by age or parental role and still enjoy the fun and vibrancy of popular entertainment. Music plays a key role in keeping this group in touch with the world their youth and their children. They want to stay young so try hard to keep up and remain engaged with what’s popular today. Familiar hits, whether old or new, are really important to the Kitchen Disco group because they are the songs everyone knows that act like a crucial bridge between the generations.

The Casuals in any market sector rarely invest the time, money or energy to explore beyond what the convenience of the mainstream has to offer. It’s likely that from time to time your brand or category will play a welcome role in a Casual’s life but for most of the time other things are way more important.

Casuals represent an important market for all sectors of media content and consumer brands. They don’t commit the extraordinary levels of personal time, attention and income to a category that distinguishes Fanatics or Enthusiasts, but the sheer number of Casuals makes them a valuable market.

The approach Casuals take to a brand category will often take one of two forms. The first is a preference for brand and product choices that reflect broad, consensual mainstream tastes. Buying something that’s ‘popular’ means the choice *must* be OK. This type of sector-specific Casual wants to ‘fit in’ rather than ‘stand out’, so chooses brands that have earned mainstream validation and confer membership of a broader, often localised, shared cultural identity.

The second type of Casual tends to be more culturally aspirational and prefers brands that confer status through socially validated taste. Their brand choices wouldn’t usually cut the mustard with a category Fanatic, but that's OK. Their main concern is to avoid any obvious category faux pas that neighbours, peers or onlookers might laugh at. Culturally sensitive Casuals and their peers have neither the time nor inclination to look deeply into categories of low personal interest. This means they are tuned to pick up on signals of authenticity and progressiveness when navigating broadly mainstream brand choices.

Finally, let's turn to The Indifferents. They tend to care very little for brands in categories that feel boring or largely irrelevant. If your brand ceased to exist tomorrow people who are largely indifferent to your category would barely notice. However, this does not mean your brand category will be entirely absent from the lives of Indifferents. Sometimes Indifferents can be induced to make a purchase if the need arises or if an offer is made as cheap and convenient as possible. But the most important role, arguably, of category Indifferents is to just be dimly aware that your brand exists and actually means something.

When enough people in a market hold the same beliefs about a brand, regardless of whether they will actually make a purchase, actual potential customers find it easier to make decisive brand choices. The psychology of this can be illustrated with a simple example. A lot of car buyers wouldn't see the point of paying a premium for a BMW car if they thought no one else knew it was a premium vehicle. That's why The Indifferents need to be exposed to your advertising.

We can create a FECI Segmentation Fan Map for your brand and market - contact us here.

Background to FECI Segmentation and the Fan Map

FECI Segmentation was originally developed in 2003 by Jason Brownlee (Founder of Colourtext) when he was Head of Audience Insight at Emap (now Bauer Media). Emap used FECI Segmentation (known as Project Phoenix at the time) to successfully develop and expand the audiences for youth media brands like Kiss FM, Kerrang! and Smash Hits across a growing range of media platforms. FECI's data modelling technique quickly found a role in other brand categories like food, financial services, sport, technology and television.

After Jason left Emap he was approached in 2008 by Mark Uttley, Head of Insight at Sony Music, to undertake a market segmentation for the company. Jason proposed a FECI Segmentation approach, which was accepted and implemented using quantitative survey data collected by Kantar. The FECI audience segments were then taken up by Matt Hart (of Innovation Pipeline) and Dan Hall (Research Manager, Sony Music) who helped Sony introduce and socialise the segmentation into the company.

Sony firmly embraced the FECI segmentation of music consumers and rolled it out across their entire global organisation. Now operating in 42 markets, Sony Music’s FECI segmentation model has been incredibly successful and is probably the world’s biggest and longest running market segmentation of music fans. This great video tells the story of that process.